The intersection of politics and technology often sparks significant shifts, and former President Trump’s vocal stance on tariffs has certainly sent ripples through the tech industry, promising what many describe as ‘interesting’ times ahead. As your guide through the evolving digital landscape, TechTalesLeo at Digital Tech Explorer is here to break down these complex dynamics.

His recent remarks to chip giant TSMC underscore the direct nature of these levies: “All I did is say if you don’t build your plant here you’re gonna pay a big tax… 25, maybe 50, maybe 75, maybe 100%.” This statement, made at a Republican National Congressional Committee event, highlights a strategy aimed at compelling companies like TSMC to move production to the US.

Following this, TSMC is now reportedly planning on investing $100 billion in the US. It’s important to note that TSMC, the world’s largest chipmaker, produces chips for major tech players including Nvidia, Apple, AMD, and even Intel.

Government Strategies: Incentives vs. Threats

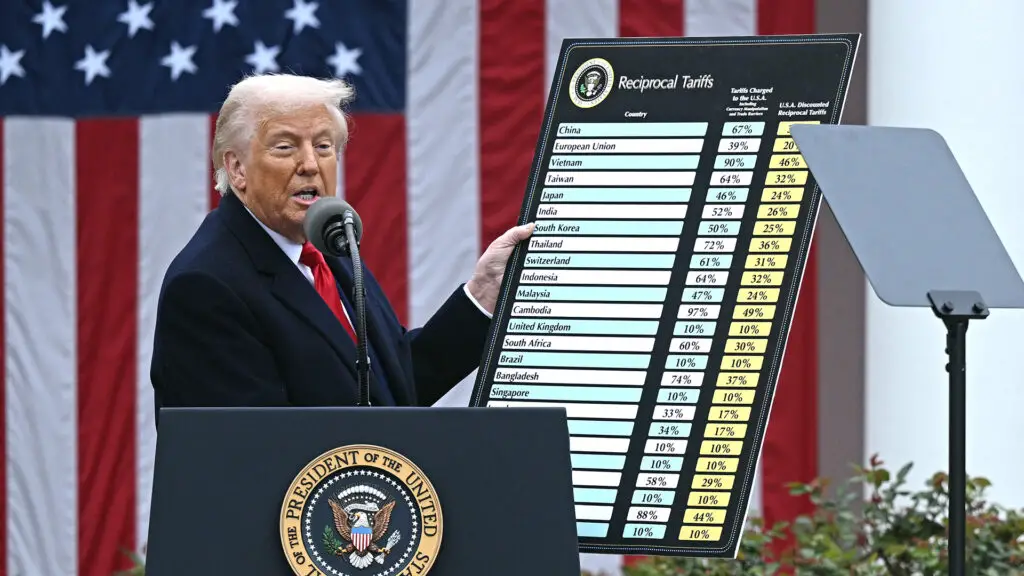

Before the more direct threats, TSMC was already planning a $65 billion investment in the US. However, a Taiwanese Presidential spokesperson clarified that “the most advanced processes will remain in Taiwan.” The primary encouragement for US-based manufacturing previously came from the CHIPS act, which offers subsidies for companies producing semiconductors in the US. Under this act, the US finalized a $6.6 billion award to TSMC in November of the previous year. This represents a significant “carrot” to attract wafer makers. Trump’s strategy, however, appears to lean more towards the “stick.” Currently, semiconductors are exempt from the 32% tariffs levied against Taiwan, but Trump’s comments suggest this exemption is maintained by the threat of potential semiconductor tariffs as high as 100%.

Tariff Impacts and Supply Chain Complexities

Tariffs essentially impose a tax on US consumers when they purchase affected goods. The underlying argument is that this will discourage the purchase of these goods, thereby impacting company profits and ideally leading them to reconsider their manufacturing locations. However, these levies can create unforeseen challenges for companies. For instance, Intel’s tariff FAQs regarding steel and aluminum illustrate the numerous bureaucratic hurdles involved. Furthermore, manufacturing chains are inherently complex, often involving multiple stages across various countries. It would be unusual for a global company not to be affected in some capacity, even if its final products are not directly taxed.

Some of AMD’s and Nvidia’s chips are reportedly now being produced at TSMC’s Arizona fab. Only time will reveal whether the substantial tariff threats from the US will decisively shift the semiconductor industry towards a more US-centric manufacturing base.

The implications of these geopolitical maneuvers on the hardware supply chain, and ultimately on consumers and tech enthusiasts, are profound. Will we see a fundamental reshaping of global semiconductor manufacturing, or will the intricate web of international production prove resilient? Here at Digital Tech Explorer, we’ll continue to monitor these developments. Stay tuned with TechTalesLeo for more insights into the forces shaping our tech world, from GPUs to the latest in AI acceleration.